Short Term Loan for Dummies

Wiki Article

Our Short Term Loan Diaries

Table of ContentsSome Known Factual Statements About Short Term Loan The Greatest Guide To Short Term LoanTop Guidelines Of Short Term LoanLittle Known Facts About Short Term Loan.Examine This Report about Short Term LoanThe 6-Second Trick For Short Term Loan

In circumstances like these, many individuals rely on short-term car loans or short-term funding as a way to spend for unforeseen or tough personal expenditures. Short-term financing is a funding option that supplies the recipient borrowed funds for short-term costs, comparable to just how a short term lending works!.?.!? Brief term finances use you obtained capital that you repay, plus passion, typically within a year or less.A substantial benefit of brief term funding is that they can make a huge difference for people that require prompt access to cash they do not have. Short-term finance lending institutions do not put a significant focus on your credit report for authorization. Much more essential is evidence of work and a constant earnings, information regarding your checking account, and showing that you do not have any type of impressive lendings.

A number of sorts of short-term fundings deal incredible flexibility, which is helpful if cash money is limited right currently yet you prepare for points obtaining far better monetarily quickly. Prior to authorizing for your short term finance, you and also the loan provider will certainly make a routine for repayments as well as consent to the rate of interest in advance.

Top Guidelines Of Short Term Loan

The benefit of short-term financing is that you obtain a relatively little amount of money today, and you pay it back swiftly (Short term loan). The overall interest settled will generally be much less than on a larger, long-lasting finance that has even more time for interest to build. No monetary service is perfect for every single debtor.

This is why it is important to weigh your alternatives in order to set yourself up for success. Homepage Have a look at the 3 leading negative aspects of getting a brief term lending. The most significant downside to a temporary funding is the interest rate, which is higheroften a whole lot higherthan rates of interest for longer-term fundings.

The Single Strategy To Use For Short Term Loan

In addition to paying back the short-term financing equilibrium, the rate of interest repayments can result in greater repayments each month (Short term loan). Maintain in mind that with a short-term funding, you'll be paying back the loan provider within a short duration of timewhich methods you'll be paying the high rate of interest for a shorter time than with a long-term loan.Long-term car loans may have lower rate of interest, but you'll be paying them over several years. Depending on your terms, a temporary financing might actually be less costly in the lengthy run. While paying back a brief term finance in a timely manner according to your set routine can be a considerable boost to your credit rating score, failing to do so can create it to plummet.

This can be damaging if you just have a little or good credit history, and also devastating to your future possibility to obtain if you already have bad credit history. Prior to taking out a short-term loan, be truthful with on your own concerning your ability as well as technique when it comes to paying Check Out Your URL back the funding promptly.

Short Term Loan - The Facts

Thinking about the top benefits and negative aspects of brief term car loans will aid you determine if this monetary tool is right for your situation. The consumer returns the amount of the car loan to the lender over the program of months rather than years., you can quickly use for a finance either online or visit this site with a bank or credit score union.The requirements for using for a car loan are: The borrower must be 18 years or over Valid e-mail address and also telephone number Although these are several of the demands that you might need to fulfill prior to applying for a lending, you do not need to have security while looking for a finance.

Short Term Loan Can Be Fun For Anyone

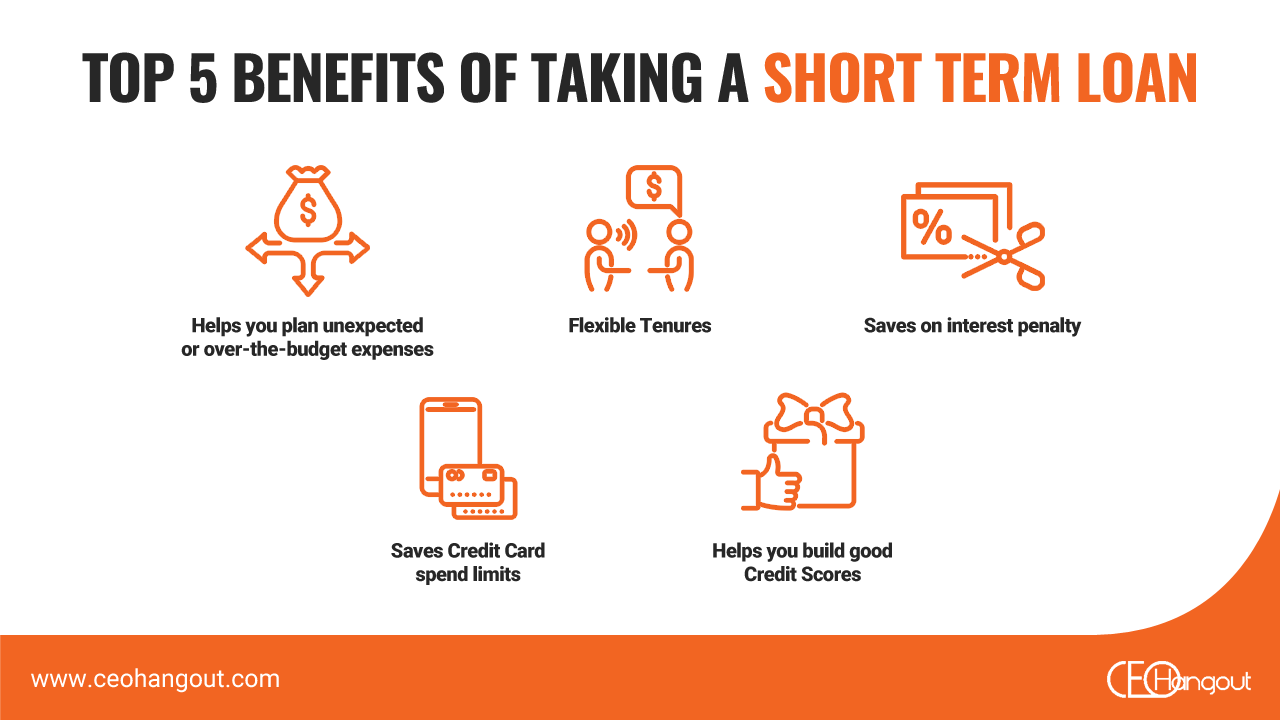

There are many advantages associated with short-term finances. Allow's review them to assist you understand just how helpful these car loans can be.

With temporary finances, you additionally obtain aid in boosting your credit score. As you are requesting a temporary finance, you need to be positive adequate to settle it in the called for timeframe. Customers of short-term finances frequently acquire lines of credit report. The most appealing and useful feature of short-term finances is that they provide flexibility and also convenience.

The Greatest Guide To Short Term Loan

Numerous lending institutions run websites that you can see straight to apply for a funding swiftly. Offered that you have to pay back the lending within a short duration, the tension connected with repaying it will not last for long!You can merely obtain a funding and also repay it as quickly as you make enough revenue.

Report this wiki page